Can You Spot a Phishing Scam?

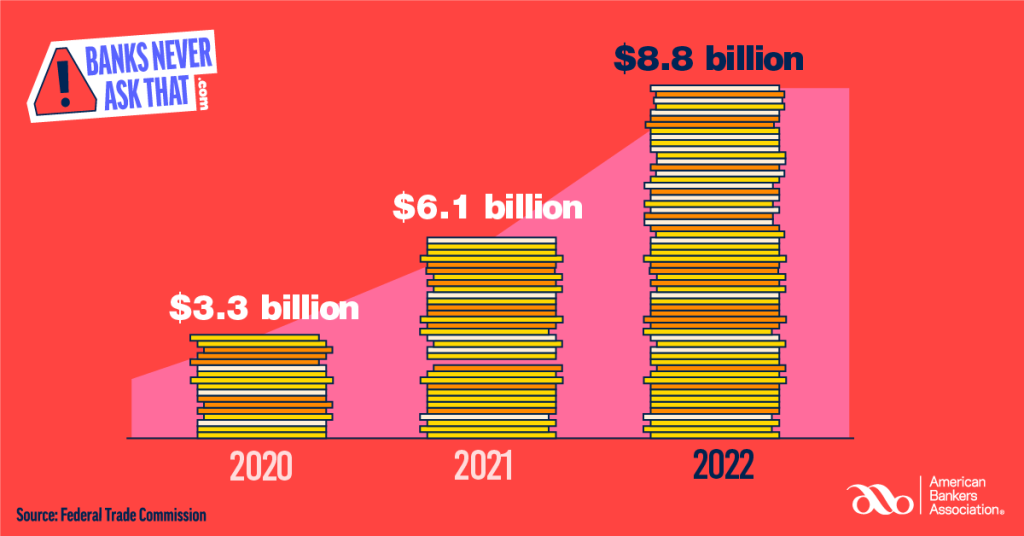

Every day, thousands of people fall victim to fraudulent emails, texts, and calls from scammers pretending to be their bank. And in this time of expanded online and mobile banking use, the problem is only worsening. In fact, the Federal Trade Commission’s report on fraud estimates that American consumers lost a staggering $8.8 billion to phishing scams and other fraud in 2022—an increase of 44% over 2021.

Traditions Bank is committed to helping you spot scams as an extra layer of protection for your account.

Online scams aren’t so scary when you know what to look for. We’ve joined with the American Bankers Association and banks nationwide to fight phishing—one scam at a time.

We want every bank customer to become a pro at spotting a phishing scam—and stop bank impostors in their tracks. It starts with these four words: Banks Never Ask That. Because when you know something sounds suspicious, you’ll be less likely to be tricked.

These four phishing scams are full of red flags:

Text Messages

If you receive a text message from someone claiming to be your bank asking you to sign in or offer up your personal information, it’s a scam. Banks Never Ask That.

Watch out for emails that ask you to click a suspicious link or provide personal information. The sender may claim to be someone from your bank, but it’s a scam. Banks Never Ask That.

Phone Call

Would your bank ever call you to verify your account number? No! Banks Never Ask That. If you’re ever in doubt that the caller is legitimate, hang up and call the bank directly at a number you trust.

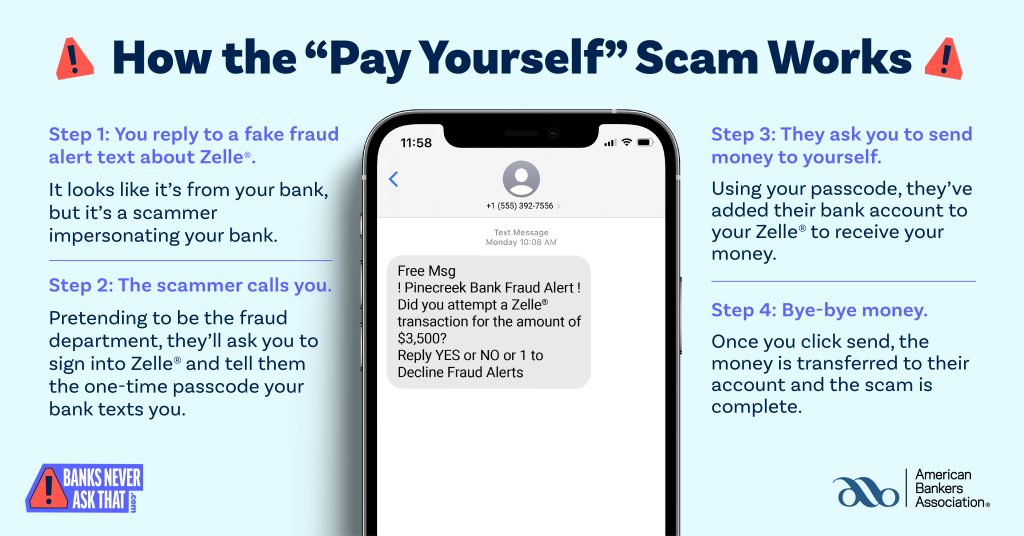

Payment Apps

Beware of text messages from someone claiming to be your bank saying your account has been hacked. The scammer may ask you to send money to a new account they’ve created for you, but that’s a scam! Banks Never Ask That.

You’ve probably seen some of these scams before. But that doesn’t stop a scammer from trying. For tips, videos, and an interactive quiz to help you keep phishing criminals at bay, visit www.BanksNeverAskThat.com. And be sure to share the webpage with your friends and family.

What Can I Do To Protect My Business?

The best protection is through education. Be aware of scammers’ tactics, and if something seems unusual, call a trusted vendor’s phone number to verify the information is correct. It is also recommended that you train your employees to be aware of potential scams. Scammers often pretend to be a trusted source and use intimidation and fear to create a sense of urgency. The Federal Trade Commission wants you to be aware of these common scams that target small businesses:

- Fake Invoices: Scammers create phony invoices for common products and services, such as office supplies, hoping the billpayer assumes it is legitimate. If the invoice is for something critical to your business operations, such as web hosting, the scammer hopes you will pay first and ask questions later. Businesses also face challenges where a fake invoice appears to come from a vendor they currently do business with, including a change to how they were previously paid. Businesses believe they are paying the correct vendor, but the monies are long gone, and the actual vendor is still waiting for payment.

- Tech Support Scams: These scams start with a phone call pretending to be a well-known company, such as Microsoft, telling you about a computer security problem. The scammer intends to trick you into paying them to “fix” the problem, which often requires access to your computer and customer records, passwords, or payment information.

- Social Engineering, Phishing, and Ransomware: Scammers can trick employees into giving them confidential information through phishing emails, social media messages, or even a call that pretends to be from someone within the organization. Occasionally, phishing emails will be disguised as routine password updates or requests that you wire money in exchange for sensitive company information.

For more tips on how to keep your business safe from online scams, read the FTC’s Scams and Your Small Business guide.